How we measure the success of your Strategy (WITH FREE TOOL)

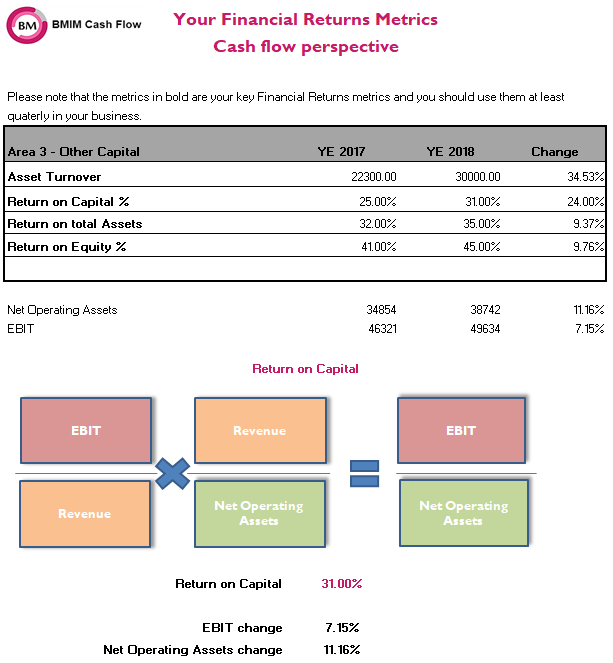

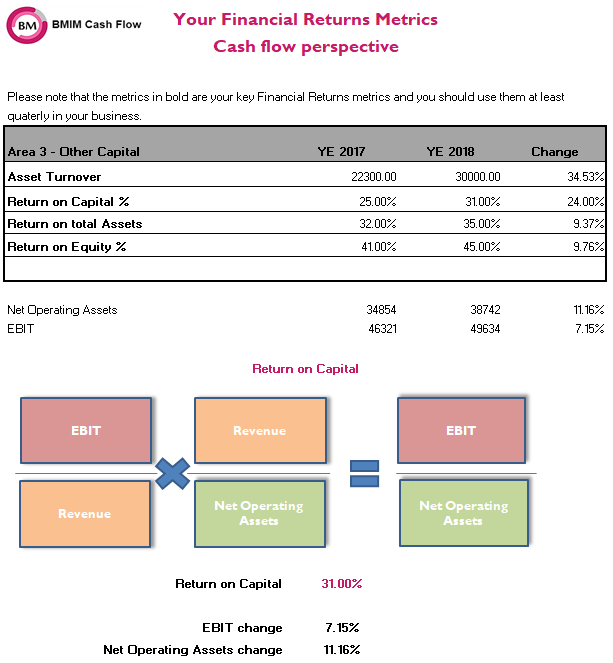

You are in business to generate returns, right? And if you are a medium size business, you should be aiming for at least 30% returns. If you are not achieving this, then you need to revisit either your profits (EBIT) or the revenue produced from your investment in assets (that is, your working capital plus your other capital).

If you’d like to make more money, this will be the most important blog for you to read. We are going to show you what you have been missing out on … we will help see the full picture of your success and more importantly see the major opportunities ahead of you.

The problem is that most businesses do not give enough attention to their balance sheet and they are missing out on key information. If you are a competent CEO, you do not only need to be a profit expert, but you also need to be a balance sheet efficiency expert, as well.

If you want to make money, you need to grow your profit faster than you are growing your investment in your balance sheet. In other terms, if you want to make cash flow, to make returns, you’d better be fantastic at profit – but you also need to be expert in the way you manage your collections from your customers, your inventory holding, your utilisation of your assets and how quickly or slowly you pay your suppliers.

With that said….let me first explain:

How your returns measure your strategy

Return on net asset, or some people call it return on capital, is ultimately a measure of the success of your strategy. The goal in any company is ‘How do you grow your profit quicker than you grow your investment in your balance sheet?’

If your return is not at the desired level, you have 5 possible strategies available to you right now:

- Fast growth – you grow your profit and your balance sheet at the same rate. Your returns remain the same. But you’ve got to find a way to fund that growth. This is what people do not realise. You need to know what your strategy is and how much funding you will need to obtain to support that growth.

- Organic growth – you grow your profit without growing your balance sheet. This strategy will increase your returns.

- Optimising growth – you get rid of non-performing assets, shrink your balance sheet and grow your profit. In other words, you grow your profit on a lower asset base. This strategy will increase your returns even more. Bear in mind though, this is more of a short-term relief rather than sustainable, long-term occurrence.

- Declining growth – you budget for same profit, but you increase your assets. If you use this strategy, you will need more cash for the investment you are making in infrastructure. Sometimes you make a decision to sacrifice profits whilst investing in a new infrastructure, because you know that, in the long run, you will be able to generate much greater profits.

- Corporate stress – you budget for lower profit and you increase your assets. Similarly to the above strategy, you need more money, more cash. Same as Declining growth strategy, you make a decision to sacrifice profits whilst investing in a new infrastructure, because you know, in the long run, you will be able to generate much greater profits.

If you are moving anywhere between organic growth and fast growth you are doing fantastic; that is, you are growing your profit faster than you are growing your balance sheet. Optimising growth is also a nice position to be in, but it is a short-term and unsustainable.

And it is About more than Just Strategy

See, you can use returns on assets to measure how effective your management is. Returns tell you whether you are doing a good job with the investment and the debt you have received to run your business.

We use the famous DuPont formula to figure out if your operations are producing satisfactory profit, given the assets being deployed. This ratio uncovers 2 major business success indicators, that is:

- Operational efficiency – EBIT/Revenue tells you how efficiently your business is operating and if you are squeezing most profits out of your revenue.

- Sales effectiveness – Revenue/net operating assets tells you how much revenue the business can generate from the least amount of asset or investment.

When it comes to profitability, anything over 10% is a good profit. However, the asset turnover can vary from industry to industry, but a low number indicates that you are carrying unproductive capital. This is exactly the reason why you should give consideration to your balance sheet, as much as you are giving to your P&L.

So like I said, there is more to returns than just strategy. Here is a fraction of what you will get when you start monitoring your returns:

- Visibility of numbers that show you how successful you are and clear understanding of what your business is doing right now.

- Awareness of what the opportunities for the business

- Clarity on the success of your strategy and transparency of where you are heading and why.

- This is a proven way to improve the returns you are getting from your businesses and other businesses you have invested in.

- TODAY: start measuring your returns and see if your financial success is what you thought it would be.

> Download my Returns Tool now! <

The best part of this is that we have designed a tool to help you generate more returns from day one! It is

Specifically Designed for People who do not have time and do not like numbers.

Listen, if you do not have time, you are not alone. And that’s why we developed the Your Returns tool to help you give consideration to the key metrics for measuring your balance sheet performance (other than your working capital). The beauty of this tool is in its simplicity and ease of use. No fancy stuff. It involves minimal data entry and there is no training required, it is all in-built.

Here is What to do next

The ‘cost’ of Your Returns tool is nil and you get it instantly as a download, when you click on the link. You can access it anywhere, immediately, without having to wait for the mailman.

Enter your numbers from your financial statements in the Your Numbers tab and in less than 3 minutes, you will be able to see your returns performance.

Read what the numbers mean in the Interpretations tab.

If your returns are not what you were hoping they’d be, read this blog again and start drawing a plan for improvement. Feel free to let us know if you need guidance or advice during any part of this process. And make it fun! Business is fun after all…

> Download my Returns Tool now! <

RELATED LINKS

Read more about BMIM Cash flow

How to fix your Working Capital problem…even if you are not “numbers person”?

Understanding your profitability picture (with FREE worksheet)

Turnover is vanity, Profit is sanity – but Cash flow is reality!

How to generate cash to self-finance your business?

Life-Cycle Financing of your Entrepreneurial Company

Early stage business financing: The pros and cons of taking money from Business Angels

Case Study: Growing broke with inadequate cash flow

Case Study: Financial turnaround and re-invention

Case Study: Restructuring for Survival and Financial Turnaround