How to re-write the financial future of your business?

In this post I am going to show you how you can uncover “the code” of your business and use it to improve your cash, profit and business value.

I am going to teach you how to use Money Multiplier for CEOs – the best kept secret … ever! You will be able to make strategic projections, see the results of your decisions instantly, and see the impact of your action immediately. You won’t need to wait on anybody or anything to tell you the future financial impact of the actions and decisions you are making right now.

I am going to explain to you why you seem to be making the same mistakes and prevent your financial abundance.

Re-write the financial future of your business

If you are ready to generate more money from your business operations and take control of the financial future of your business, then download our Money Multiplier for CEOs below. You can re-write the whole financial future of your business and make a lot more money than you currently are and I want to show you how.

> I want my Money Multiplier for CEOs <

The missing piece to your Financial abundance

When we talk about cash flow most people think of a cash flow statement (general availability of cash). This is not what we are referring to.

Cash flow means the change in cash and debt balances across a period – most often 12 months. So this is not how much you are selling or how much profit you are making. This is about how much your cash and debt balances have moved year on year.

As a CEO, it will be your dominant intent to see positive change of your cash balance and negative change in your debt balance. But is it?

The problem is that the flow of cash is not something that is one-off. It is a continuous process that you must sustain; otherwise your business won’t survive. That is why we use the term cash FLOW.

Another problem is that it is not always the INCOME that is the issue. It is the ability to link your day-to-day decisions with cash flow in the future that is the missing piece. You make decisions now about making and spending money without knowing the effect of those decisions on cash flow in 12 months’ time.

Are you aware of the financial future into which your decisions are taking you and your business?

What does the cash flow future for your business looks like?

The Code of your business…financially

The single, biggest thing stopping CEOs making more money from their business operations is their understanding of “the code” of their business.

Every business has a code that underpins how you operate, from a financial perspective. Not knowing your code is like trying to run a business blindfolded.

The code of a business consists of:

Four Drivers of Profit

- Price

- Volume

- Direct costs

- Overheads

And three Drivers of Working Capital:

- Debtors days

- Inventory days

- Creditors days

If you are trying to improve your business, you should focus on improving one or all seven drivers.

As a CEO, you should be aware of how each of these drivers impacts your cash, profit and business value.

There is a huge misconception around making money in a business. Most people think that this is a financial matter and belongs to the Finance Director and/or the Accountants.

But it is your daily decisions that impact your income generating strategy most. Without knowing how your actions and decisions impact cash, profit and business value you are likely to make decisions that do not serve your financials.

This is when Money Multiplier for CEOs becomes really useful.

The power of the Money Multiplier for CEOs

We love the Money Multiplier for CEOs– we love implementing it and we love using it.

Every time we introduce it to a business, they get it straight away! It is simple and easy to use by literary everybody in a business.

It is useful for businesses of all types and sizes.

You won’t need to calculate anything, it does all complicated calculations for you! The objective here is to help you make better informed decisions and focus your energy more on strategy.

The Money Multiplier for CEOs is so powerful. It uncovers ‘the code’ of any business in a way that no other tool does. If you want to make more money from your business operations you need to know “the code” of your business.

The code of the business is very personal to every business. It serves to guide your decisions and actions so they are in line with your intentions to make more money.

And how do you know if this is a good decision you are making? Simply, because it makes you money.

The Money Multiplier for CEOs in action

The Money Multiplier for CEOs shows you if your decision will cause the business to generate more cash flow and profit in the next 12 months period, or less.

Here is how to see that.

Open the worksheet and input your financials for the last 2 years in the “Your Numbers” tab. Then go to The Impact of One tab to see the results.

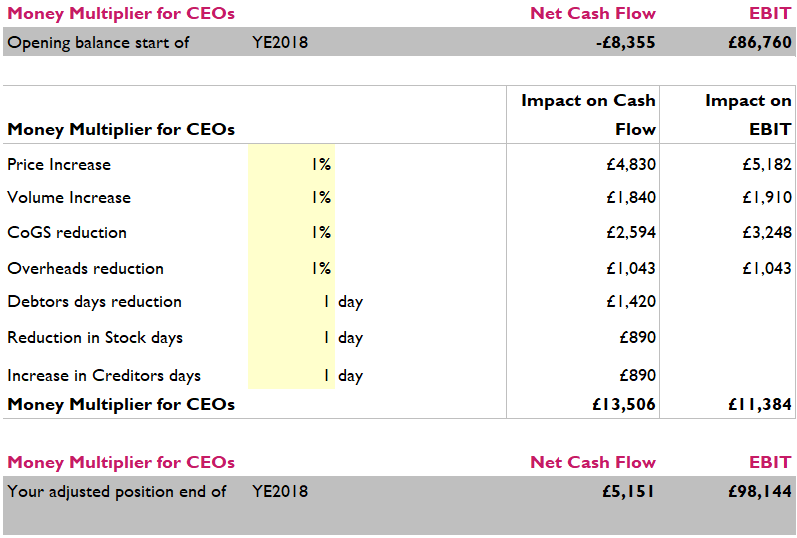

Now you are able to see clearly how much more cash flow and profit you could expect at the end of the year, as a result of changes by 1% or 1 day only in each of the drivers.

Stated very simply, in a way that anyone can understand, the 1% change of the profit drivers tells you what you need to do to improve your business. For example, take a look at the following table.

You can clearly see that the biggest impact on cash flow and profit comes from price increase. Just 1% change in price generates £4,830 in cash and £5,182 in profit for this business. You can also compare the impact of price increase with the impact of generating more sales. You can see that the impact of price increase on cash and profit is more than 2x the impact of volume increase on cash and profit. You could be saving yourself a lot time and effort if you were to increase the price, rather than sell more.

When it comes to Working Capital, using the same example, below are the results generated by changing the three drivers of working capital:

So by changing each of the drivers just by 1% and 1 day the business in our example can expect to see £13,506 more cash and £11,384 more profit by the end of the year.

Creating STRATEGIES for improvement

When you know the code of your business, discovering the strategies to help you improve your business becomes so much easier. The “code” of your business directs you where to look for improvements. It tells you where the opportunities lie.

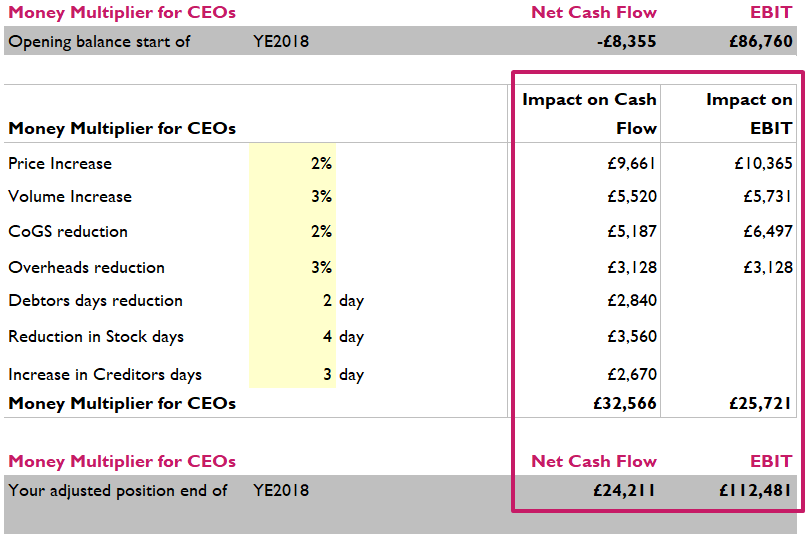

Using the same example, this business decided to change a few of the drivers only. You can notice the significance in impact on their cash, profit and business value in the table below.

When you make a decision on what drivers you want to change to improve your cash and profit, your only work then is to monitor the progress of the change until the next meeting (you could meet monthly or quarterly, up to you and how much importance you put on your cash flow, profit and business value).

How to use the Money Multiplier for CEOs in decision making?

When making decisions you can now check what you are doing to your cash, profit and business value.

You link your decision to one or more of the drivers. You then work out the change, in present age terms or days in one of the drivers. For example, one of our partner financial adviser asked us recently “Bibi, my client wants to increase the number of beds filled, in his hospitality business, from 60 to 62. What would that do to his cash flow and profit?”.

So we worked out that this decision links to ‘volume’ financial driver. And would increase the volume by 3.3%.

Another example we have is changing the terms of business. A client of ours signed an agreement recently with a distributor, who asked for 45 days payment terms. This was factored in the pricing, as we planned to get factoring company to finance that. Although this new deal did not increase the debtors days, the arrangement with the factoring company increases the overheads which has adverse impact on cash flow and profit

If, however, a decision to improve your cash flow and profit has already been made and you want to see what change will yield most increase, than you take a slightly different approach.

You follow the same process as with discovering “the code” of your business.

There are unlimited ways in which you could create changes to the financial drivers, but we suggest you start with what makes most impact first. Once you have exhausted this, you could move onto what is easiest to change.

Change the financial future of your business

If you are ready to generate more money from your business operations and take control of the financial future of your business, then download the Money Multiplier for CEOs below. You can re-write the whole financial future of your business and make a lot more money than you currently are.