Finding “True North”: How to tell if an opportunity is pulling you in the direction of more money?

Do you ever feel torn in 2 opposite directions when you see what could be an opportunity or even when you need to make a decision which way to go? And how do you know what is going to pull you in the direction of more money?

When a new idea, opportunity or problem presents itself to you and your business, do you know clearly how to go about it? And do you know if that is going to take your cash flow to where you want it to be?

In this post we are going to demonstrate how your True North could be directing your path and pulling you “North”, towards more money.

Cash Flow Improvement tools for CEOs

If you are ready to make more money then you need easy to use tools that will give you accurate information when making money decisions, quickly. CEOs who use automated tools move faster than those who don’t. And they make better decisions and make a LOT of money.

If you think that they calculate numbers in their head, you are wrong. Get your cash flow improvement tool today to grow your business faster.

> Give me my Money Multiplier for CEOs <

Turn your back

Running a business can seem like an extremely busy and hard at times. You have 101 decisions to make and problems to solve every day – operational problems most of them.

Then there are days when everything goes wrong and you ask yourself “Am I doing the right thing? Should I continue with this?”

How do you know when your decisions are directing finances in the right direction?

How can you confidently turn your back on new opportunities without a fear that you aren’t going to miss out on something?

We call the solution to this problem, True North.

True North

True North is about finding the direction that you’re going to face. You might have a purpose, but it’s going to take more than that to achieve everything you want.

How do you know your finances are going in the right direction? Are there multiple ways to get to your purpose? If your financial purpose is to achieve financial independence or a financial balance, HOW are you going to do that?

The values and beliefs that you hold close in your heart is what guides your True North. You already have an internal compass which knows how it’s going to get there, you just have to listen.

We want to find the direction that you’re going to take your business, financially. We have an end goal in mind, or a purpose. But we have to know what it’s going to take to get us there.

One of the biggest pitfalls that people fall into, is having their purpose clear in their mind, but they haven’t thought about the journey it takes to get there. If your business financial goal is to create financial momentum or even come out of a financial despair, are you going to do that through gambling or building a successful business?

Captain

We’re the Captains of our own vessel. The concept of running a tight ship stands true for our finances and our business too.

Captains have to make tough calls and difficult decisions – choosing one person to fire over another, or leaving an opportunity on the table.

Imagine navigating to your purpose as a voyage on the open ocean. We’ve no maps, this is all uncharted territory. Our values and beliefs are our compass and we know that great riches lie to the North of our position.

Some days, it’s plain sailing. Wind in our sails, bright sunlight and all seems well. We’re moving fast and it feels like nothing could slow us down.

However there are going to be times when islands appear, loaded with opportunity and distractions. It’s up to us to decide whether we follow our True North or plot a different course for a new heading.

As the Captain, you’ll have to decide which path to take. And it isn’t always easy. Threats and distractions can be disguised as opportunities. What looks like an easy win and an obvious choice, can turn into a mirage: a sandbank and shallow waters that holds your ship and journey hostage.

How can you tell if this opportunity is right for you and your business?

If your intention is to make more money, than when considering an opportunity, you’ve got to consider the impact it is going to have on your money. More specifically, how this opportunity is going to influence the drivers of cash and profit (and business value).

Let’s demonstrate through an example here how this really works.

One of our clients wanted to stabilise the market and they wanted someone else take care of their sales, at least the bulk of it. They believed that stability of sales and continuity in revenue is what the business needed. So they appointed an exclusive distributor for their products.

Before they went ahead with this decision they had to consider a number of important drivers of cash and profit:

- How much revenue they were going to compromise as a result of the price difference between selling direct and going through distributors.

- If the consistency in sales was more important than selling at lower price.

- They also had to consider if increasing the volume of sales could compensate for the lower price.

- What were the requirements for promotions and how much more the price was going to be compromised.

In addition to this, they had to consider what was going to happen to their relationship with the market – were they going to lose control over the market or not.

Here is what we did to help them in their assessment of this opportunity. We took their financials and using one of our Cash Flow Improvement tools, the Money Multiplier for CEOs, we analysed each of the above points and…a little bit more.

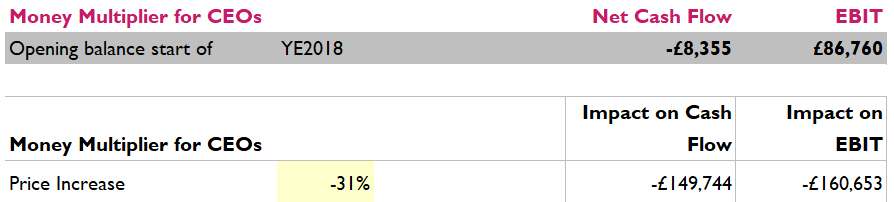

#1. Price

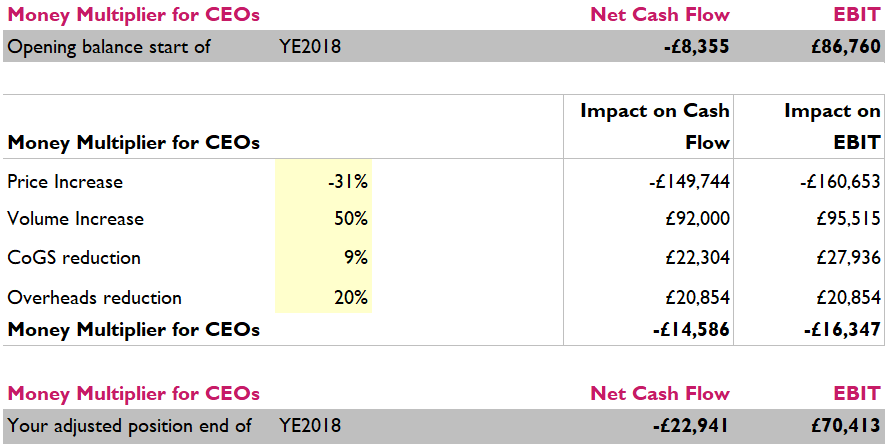

So selling through the exclusive distribution was going to reduce the price by 31% (to allow for enough cut for all players in the distribution chain). This reduction creates a loss of -£149,744 in cash and a loss of -£160,653 in profit, bringing the cash position down to -£158,099 and the position of profit to -£73,893.

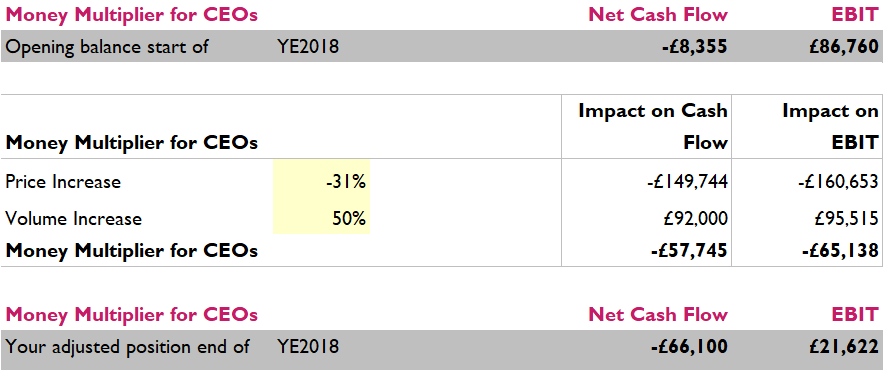

#2. Volume

So selling through the exclusive distribution was going to reduce the price by 31% (to allow for enough cut for all players in the distribution chain). This reduction creates a loss of -£149,744 in cash and a loss of -£160,653 in profit, bringing the cash position down to -£158,099 and the position of profit to -£73,893.

As per the above table, volume increase by 50% increases the cash flow and profit by£92,000 and £95,515 respectively, bringing the cash flow for the next 12 months to -£66,100 and the profit to £21,622.

Now, we knew that the distributors were going to increase volume of sales and we were certain that in year 1 this was going to be by 50%, at least. So we included this assumption in our assessment, as shown above.

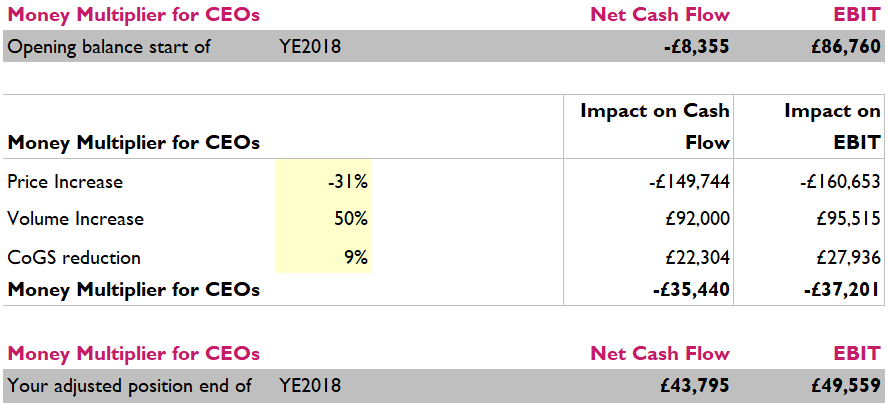

#3 Direct Costs

So as per the table above, 9% reduction in direct costs generates £22,304 in cash flow and £27,936 in profit over 12 months period, bringing the cash flow loss to -£43,795 and the profit to £49,559.

The business was originally selling though self-employed agents, so giving the market to the exclusive distributor was going to make them redundant, reducing the direct costs (the commission they were getting) by 9%.

#4 Overheads

The business employed 1 sales person. Making this person redundant was going to reduce the overheads by 20% bringing the cash flow to -£22,941 and the profit to £70,413 as per the above table.

# Debtors days

The business employed 1 sales person. Making this person redundant was going to reduce the overheads by 20% bringing the cash flow to -£22,941 and the profit to £70,413 as per the above table.

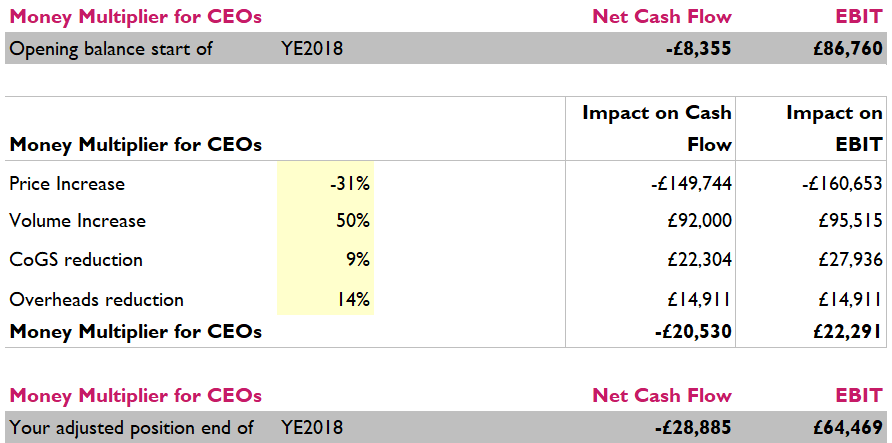

The distributor’s payment terms were 45 days and we negotiated them down to 30 days. But our client still could not afford to finance such a long cash cycle, so we had to find a solution for this.

We hired a factoring company to help us finance this 30 days payment terms. The charges for factoring were going to increase increased the overheads by 5.7%, changing the overheads reduction to 14.3%, and reducing them impact of overheads reduction on cash and profit from £20,854 to £14,911 each.

The work did not end there. The client still went ahead with the deal. The loss in cash flow and profit was going to be covered by retaining a segment of the market where they could sell direct ad therefore make more money, as well as boosting the online sales through their website.

So we presented the above analysis to our client and showed them what the loss in cash and profit was going to be in the first 12 months, if they went ahead with the deal. They were amazed with the level of accuracy we demonstrated with our analysis.

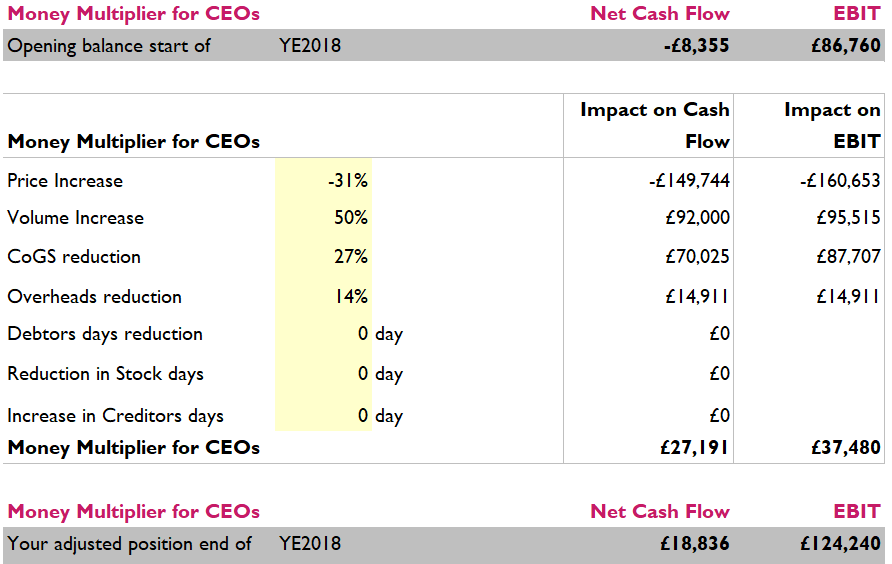

The focus on making more money also inspired our client to look for a cheaper packaging company. They managed to reduce the direct costs by further 18%. This turned the cash flow loss into a cash flow profit of £27,191 and their profit loss into a positive profit of £37,480.

Cash Flow Improvement tools for CEOs

If you are ready to make more money, then you need easy-to-use tools that will give you accurate information when making money decisions, quickly. CEOs who use automated tools move faster than those who don’t. And they make better decisions and make a LOT of money.

If you think that they calculate numbers in their head, you are wrong. Get your cash flow improvement tool today to grow your business faster.