Setting your Cash Performance Criteria

This post will help you track your PROGRESS towards your Ideal cash flow profile, so you can clearly see IF you are moving towards the desired cash flow position. And more importantly, this post will help you stay MOTIVATED in your cash improvement efforts and help you NAVIGATE your ‘ship’ to the desired destination.

“How do I stay motivated? Every time I try to make improvements, I seem to end in the same position as before. How do I know that I am improving my cash flow and my returns?“

We want 10/10 in life. And yet, we are hardly ever willing to give 10/10. If you have to give 10/10 for effort, improvement, drive, focus, discipline and motivation, most people’s question is “for how long?”

The way to stay motivated is to KNOW that you are getting closer to your goal. The reason people become unmotivated is because they cannot see how what they are doing is connected to their goal, or they cannot see progression.

So when you know that you are not moving in the right direction, it will feel uncomfortable, maybe even painful. But you have to decide if that temporary pain and ‘uncomfortableness’ is more important than your desire to have more money.

There is no better feeling than knowing that you are getting closer to your desired cash flow position. You can change tactics to move faster, or slow down; you can change tactics to go back “on track” when you know you’ve come off it. You know that you have the full control over your decisions and actions.

What is your Ideal Cash Flow Profile?

Here we start, by constructing visions of your desired cash flow, in the future. If you have a method for this, then use that.

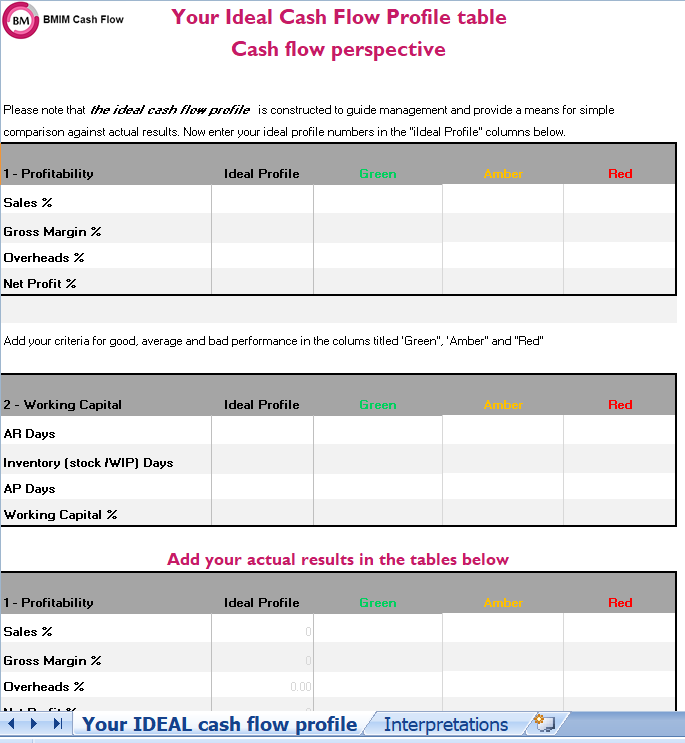

Otherwise, feel free to use our Framework for constructing your Ideal Cash Flow profile; download the Ideal Cash Flow Table and start understanding what your cash flow could be….and what you could have.

Get up to speed with the desire that you have

Acknowledge that you are on your way to something better.

FOCUS your attention on closing the gap between where you are in relation to where you want to be – your journey to fulfilling your desire for generating more cash flow in your business.

So what does this mean? Take each KPI for cash performance and see what improvements you could make to move from where you are to where you want to be.

This is your vehicle to change. It will provide you with ideas and inspiration needed to create the changes.

Take your sales, for example. Start with the desired situation of your sales (your revenue, type of clients, number of clients, prices, volume etc.) Do not hold back! You are not wanting more than you believe you could have.

Now think about what possibilities you have to move your sales from where they are to where you want them to be.

Repeat this exercise for the remaining 6 KPIs of cash performance: your gross margin, your overheads, your net profit, your debtors days, creditors days and inventory days. Use our Money Multiplier for CEOs to ease your efforts and have more fun in the process!

Track your progress

When you decide the changes you want to make, you want to track the progress you are making – are you moving in the desired direction?

You already have your ideal profile to set the benchmark and to provide means for simple comparison against actual results. You then need to set ranges of results, colour coded, so you can see visually how you are performing.

Use green for good results, yellow for average and red for bad results. The more results are green, the more cash your business is producing. The more red and yellow you see, the worse your cash performance.

We found that people respond better to colours, so use colours when displaying your results to attract people’s attention and keep them focused.

Setting ranges for your cash KPI results

Here is the big question. What constitutes green, amber and red in terms of KPIs for your cash performance?

You have an ideal cash flow profile and you know what you are aspiring for. But how do you know that you are on the right track?

What number, or range of numbers is your indicator that your results are within the ‘normal’ range or the ‘desired’ range?

Below is a guidance on what constitutes good, average and bad for each of your KPIs for cash performance:

1. Sales %

Clearly you want your sales to be 100% and depending on your strategy 100% will represent different number. For a growing or expanding firms, this is one of the most important KPI of performance.

For this KPI, set the ranges for cash performance as you see fit, as this should be in line with your strategy.

2. Gross Margin %

Your gross margin is an indicator of your pricing strategy and how well you control your direct costs. Use your competitors to compare your ideal gross margin, but do not rely on different industry data.

Your gross margin ranges of cash performance should not be more than 0-2% below the ideal gross margin.

For example, if your ideal gross margin is 40%, then:

- > 40% = GOOD

- 38%-40% = AVERAGE

- <38% = POOR

3. Overheads %

Whereas direct costs are less flexible, overheads reduction is one of the strategies CEOs implement when they want to increase their net profit margins. This, however is not always feasible for growing and expanding firms where you have to spend more on marketing to drive sales and employ more people to operate your business.

Your overheads ranges for cash performance should be up to 0%-2% below your ideal overheads.

For example, if your ideal overheads are 30%, then:

- >30% = GOOD

- 28%-30% = AVERAGE

- <28% = POOR

4. Net Margin % (EBIT %)

Your net margin will vary based on your sector and industry, but it is one of the most used indicators of your company performance by banks and investors. What it does not tell you though is how much money your business has the potential to make.

So unless you own a supermarket or a grocery store, where the profit margins are between 1%-5%, you should be aiming for at least 10% net margin. 10% should be your new breakeven!

Again, when setting the EBIT ranges to indicate how well your cash is performing, you should not go 0%-2% below your 10%. In other words,

- >10% = GOOD

- 8%-10% = AVERAGE

- > 8% = POOR

5. Debtors days

Your Debtors days would depend on your credit terms. If your product or your brand is so strong, customers might be willing to pay up front or on delivery. Make sure to take advantage of this.

When setting the ranges for your debtors days results, you should not go above 0-10 days from your ideal debtors days.

For example, if your ideal debtors days is 60 days (this could correspond with 30 days payment terms, as on average your debtors will pay within 60 days), then:

- < 60 days = GOOD

- 60-70 days = AVERAGE

- > 70 days = POOR

6. Inventory (stock/WIP) days

Your inventory days are linked to your business model and type of business (product-based or services-based).

When setting the ranges for your inventory days results, you should not go above 0-10 days from your ideal inventory days.

For example, if your inventory days is 30 days then:

- < 30 days = GOOD

- 30-40 days = AVERAGE

- > 40 days = POOR

7. Creditors days

Your creditors days depend on your relationship with your suppliers. As such, you do not need to set ranges for this KPI.

8. Working capital %

Your intention should be to reduce this number (your working capital as a percentage of sales), as less money you lock into funding your sales, the more money is left for you (after paying your overheads).

Your working capital ranges for cash performance should be up to 0%-3% above your ideal working capital.

For example, if your ideal working capital is 24%, then:

- < 24% = GOOD

- 24%-27% = AVERAGE

- > 27% = POOR

Wrap up

You now have a guide on how to set the ranges for your cash performance. Download our Ideal Cash Flow Table and follow the guide above to start moving your cash towards where you want it to be.

> Show me my Ideal Cash Flow Profile table now! <

Add your cash KPI results to this table, to see what range they fit within – green, the amber or the red. What are your results telling you?

Display your results, so your team could see how they are performing.

A good cash performance needn’t be your responsibility only. Involve your team in your improvement efforts. Make it your team’s responsibility also. More on this topic in a different blog.

Follow along with me and other businesses as we discover exactly how you can generate more cash and returns for you and your business.

In a meantime keep us posted of your progress, or just send us your comments: info@bmim.co.uk