Digital Transition: The ultimate CEO and entrepreneur’s guide

“Companies rarely die from moving too fast and they frequently die from moving too slow”.

– Reed Hastings, CEO of Netflix

Did you know that 80% of companies are at risk of going out of business in the next 5 years? ‘Traditional’ established businesses are in a red-danger-zone right now as they can be easily kicked out of the market. This epidemic threat affects ‘established’ businesses who are responding wrongly to the threat of disruption in their industry. They either ignore it as they think they are safe or overreact by throwing money at new technologies/dropping prices without estimating the financial impact of their decision. Both of these reactions will lead to fatal consequences such as loss of market share, painful profit dropping, rising customer complaints and inability to develop new growth opportunities.

What does it take to become a Digital Winner in your industry?

Step 1: What is happening around you right now?

Increase your awareness and be willing to respond audaciously to disruptions. You need to stay vigilant and pick up on the signals and work out when the acceleration will happen. The key questions you should ask yourself are:

- Are you aware of the trends?

- How do you react to these trends?

- How do you recognise a hype/noise/fad from real trend?

- Is your strategy adequate and scalable so you could act when disruption happens?

- What are the recent changes in your competitors’ business model?

Step 2: Where are you now?

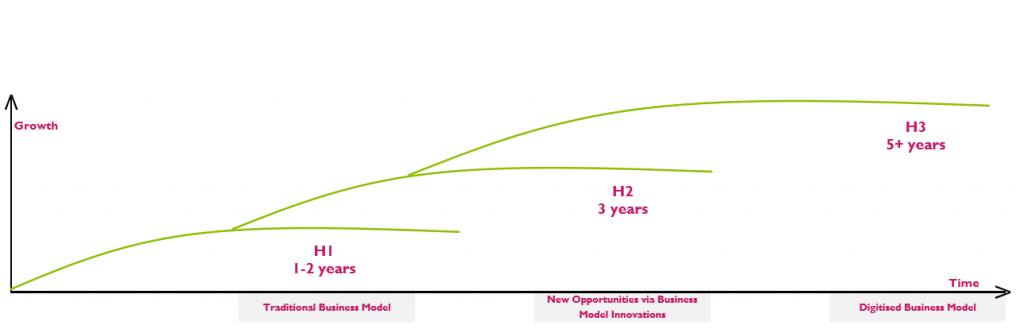

Assess where your company is in its digital development (see Fig 1 below). This will help you determine your digital ambition and map out the right speed of development relative to your industry and situation.

Fig 1: Key stages of Digital Development. Click here for your free assessment test

For example, if you are in the early stages of development (H1) in a fast moving industry, the best strategy is to partner. If however you are in the mature stages of development (H2) in a slow-moving industry, you are well positioned – but be careful not to outrun your customers! It is important to constantly be in tune with the market to see how they respond to your digital initiatives.

Gain sharper insight and escape myopia by challenging your own ‘story’ and disrupt long-standing beliefs about how to make money in your changing industry landscape. Reframe the ‘old’ beliefs find out value creation in your industry and then turn it on its head to find new forms and mechanisms for creating value.

Step 3: Act boldly

Thirdly, commit to nurturing new initiatives after validating the core tech and economic drivers. But do not be surprised if the motivation is not there. The disruption’s impact might not big enough to dampen earnings momentum. The ‘new’ business has to be kept separate from the ‘old’ one: don’t be afraid to allow the products to compete! It’s better that you canabalise your own products rather than being overtaken by competitors. Full commitment is needed to support these experimental ventures as this is the key to protecting your existing revenues. You might encounter resistance from your team, looking for quick efficiencies rather long-term benefit of radical change. This is also why having 2 separate business is advantageous: treat the new business like venture capital growth style plan and the old one like private-equity firm where cash is king.

Step 4: The right time to merge the ‘old’ and the ‘new’

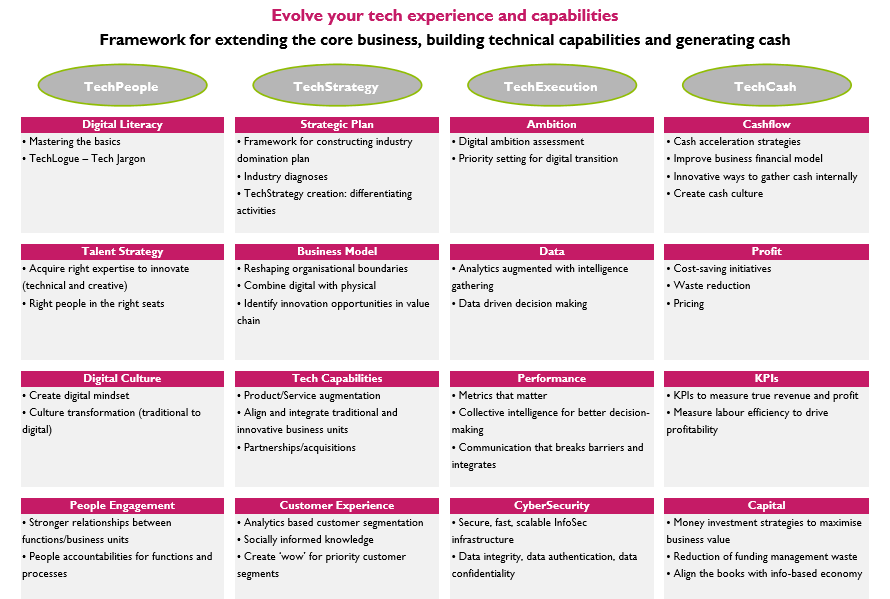

Allocate financial resources and talent and increase management attention. Once the new model has proven to work, aggressively shift resources to the new venture. Making this shift requires overcoming inertia; there should be willingness to run the new businesses differently. As the budgets start to tighten up to deal with the need for extra cash, the leaders of the core business might be reluctant to give up their resources. Boards need to show flexibility too, as they need to show willingness to accept lower baseline performance, instead of pushing the management team to increase performance in the core business. It is now time to prioritise the survival of your business over its sustainability and profits. You may want to use guide such as the 4Ts Framework (Fig. 2) for companies to navigate through their digital development. If the capabilities are not available in-house, companies should look to bring in experts to support the transition.

Fig 2: The 4Ts Framework is a free downloadable guide

What are you waiting for?!

The narrative ‘it is not happening to us’ is all too tempting to believe. The secret is to monitor the underlining drivers, not just the financial performance (although profitable, it is growing sluggishly). When it comes to disruption, strategy barely buys time. Most companies are good at dealing with obvious emergencies, rapidly corralling resources and acting decisively. But they struggle to deal with the slow, quiet rise of an uncertain threat that does not announce itself. Disruption underplays itself as our attention is on the pressures of short-term and what is real.

> Request my free meeting and help me grow my business today! <