How do you know the price is right? 8 Steps to better pricing!

When we think about pricing products or services the first question we often ask is “What should the price be?”. In fact what we should be asking is “Have we addressed all considerations that will determine the correct price?” Pricing is not a matter of getting just one thing right. Proper pricing requires careful and consistent management of a number of issues.

Follow these steps to set the right price and sustain its benefits:

▼ 1. Assess the customers’ perceived value your product or service

Rather than applying a mark up on the product cost, you should first think about how your customers will value the product. Use market research and your sales team to get this information. Using this approach will help you maintain the price level, secure a price premium, improve your margins and increase your market share.

▼ 2. Look for variations in the way customers value your product or service

Customise your products and prices for different customer segments to earn greater profits. A product will often have higher perceived value for an “ideal” customer than it will for an average prospect. How can you spot value variation and opportunities for price customisation? Answer 3 questions:

• Do customers vary in intensity of use?

• Do customers use the product differently?

• Does product performance matters more to some customers even if the application is the same?

▼ 3. Assess customers’ price sensitivity

Price elasticity is what you should pay attention at. This is 1% change in price should trigger 2% change in quantity. If measuring price elasticity is too complex and you do not have enough resources, you can examine the factors influencing price sensitivity in 3 areas: customer economics, customer search and usage an the competitive situation.

▼ 4. Identify an optimal pricing structure

Determine whether to price the individual components of a product or service or a “bundle”. Two important issues to consider when creating a pricing structure is whether to offer quantity discounts and whether to offer bundle pricing.

▼ 5. Consider competitors reactions

Ask yourself how any change in price will affect competitors? What will their first thoughts be when they see the change? What would you do if you were the competition? And can you respond to that action effectively? You must also consider the overall impact of the new price on the industry’s profitability.

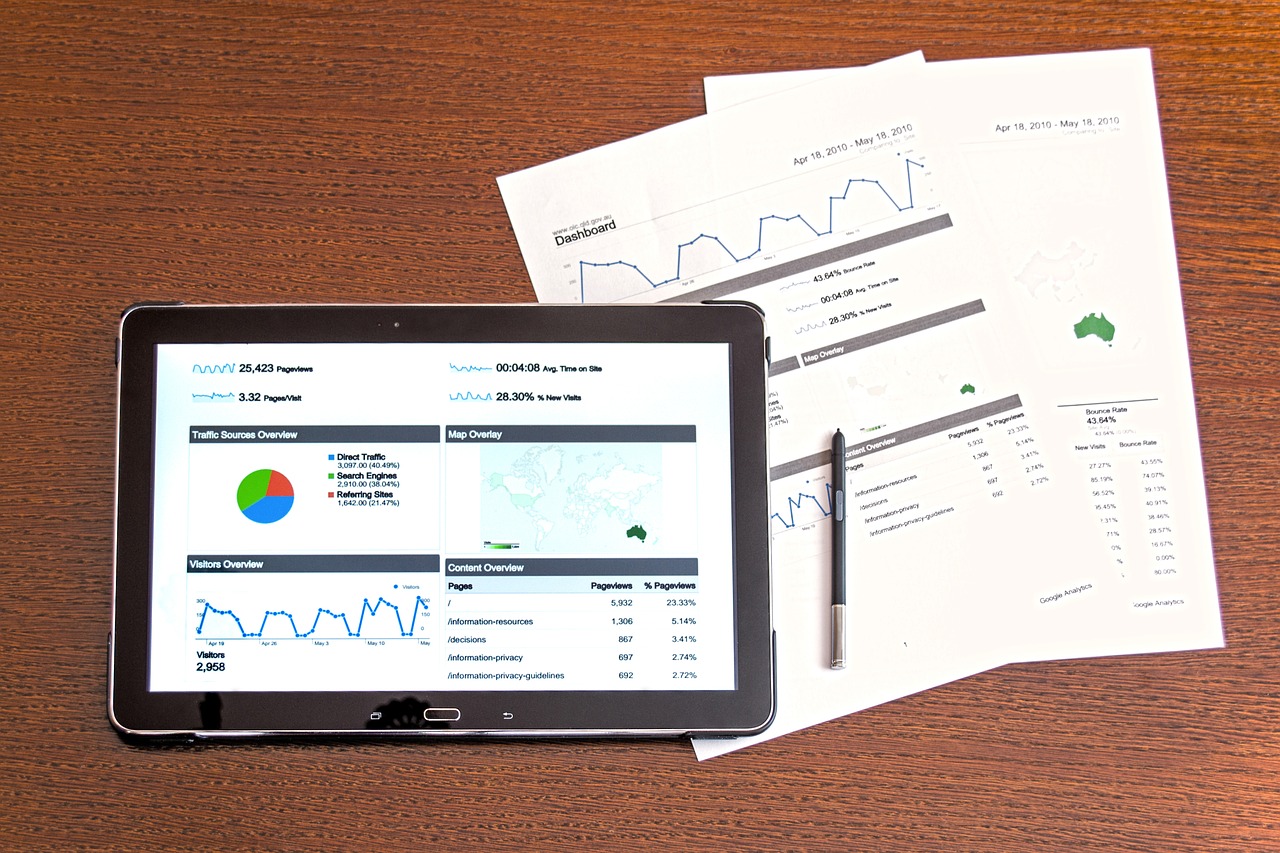

▼ 6. Monitor final prices, realised at the transaction level

Pricing terms and conditions can impact the bottom line e.g. discounts for early payments, rebates based on annual volume, rebates based on prices charged to others and negotiated discounts. Analyse the full impact of the pricing programme, measuring and assessing the bottom-line impact.

▼ 7. Assess customers’ emotional response

Consider the long term effects of customers emotional response and the short-term economic outcome. Use simple market research procedures to assess customer reaction in terms of both perceived fairness an purchase intention.

▼ 8. Analyse whether the returns are worth the cost to serve

Some accounts demand product customisation, just-in-time delivery, small order quantities etc. at the same time they are paying late, negotiating price aggressively, taking discounts that have not been earned. These accounts, called strategic accounts get a lot more then what they pay for. Weigh up the costs and the benefits of having these accounts or start charging premium.

An effective pricing process can’t be created or implemented overnight. This does not mean it cannot be achieved. All it takes is getting lots of little things right and staying on top of this process to ensure improvements are sustainable.

> Request my free meeting and help me grow my business today! <

Post originally published via ICAEW Business Advice Service – click here